In 2018, Russia began inserting an unusual clause into euro and dollar sovereign bonds, seemingly designed to circumvent future Western sanctions. The clause worked by letting the government pay in roubles if sanctions cut off access to dollar and euro payment systems. The clause received little scrutiny at the time, perhaps because Russia used a state-owned bank, rather than a global investment bank, as underwriter. But with the invasion of Ukraine and the ensuing sanctions imposed by the United States and other governments, the relevance of the clause has become clear. This Essay examines how the market reacted to the clause before and after the invasion. Our expectation was that the market would charge a premium for bonds with the clause. Investors bought euro and dollar bonds, after all, because they did not want to be paid in roubles. Yet contrary to expectations, investors seemed to prefer bonds that allowed for payment in roubles over bonds that did not. This surprising finding has considerable implications for other countries that may lose access to foreign currency for reasons that are more benign than Russia’s war of aggression. Despite its sordid provenance, Russia’s sanctions-busting clause might turn out to be a positive innovation that could benefit countries facing unexpected crises. Indeed, had Ukraine included such a clause in its bonds, the benefit would have been enormous.

Introduction

After the seizure of Crimea in 2014, the United States and other governments imposed economic sanctions on a range of Russian entities and individuals. Russia’s subsequent invasion of Ukraine in late February 2022 prompted draconian new sanctions, ranging from trade restrictions to a block on the Russian central bank’s ability to access foreign currency reserves.1 1.For a comprehensive timeline of sanctions imposed against Russia by the United States and other countries, see Chad P. Bown, Russia’s War on Ukraine: A Sanctions Timeline, Peterson Inst. for Int’l Econ., https://www.piie.com/blogs/realtime-economic-issues-watch/russias-war-ukraine-sanctions-timeline [https://perma.cc/MEL7-E7QH].Show More Although unprecedented in scope, it was no surprise that the United States resorted to sanctions to punish a foreign adversary. Countries have long used economic sanctions to achieve foreign policy objectives.2 2.Benjamin Coates, A Century of Sanctions, Current Events in Historical Perspective, Ohio St. U.: Origins (Dec. 2019), https://origins.osu.edu/article/economic-sanctions-history-trump-global?language_content_entity=en [https://perma.cc/B94U-3X9F].Show More The global dominance of the U.S. payments system, and the dollar’s dominant place among currencies, has made this a tempting practice for the United States.3 3.See, e.g., America’s Aggressive Use of Sanctions Endangers the Dollar’s Reign, Economist (Jan. 18, 2020), https://www.economist.com/briefing/2020/01/18/americas-aggressive-use-of-sanctions-endangers-the-dollars-reign [https://perma.cc/K2HY-SG4W]; Karen Yeung, How the US Uses the Dollar Payments System to Impose Sanctions on a Global Scale, S. China Morning Post (Aug. 25, 2020), https://www.scmp.com/economy/china-economy/article/3098691/how-us-uses-dollar-payments-system-impose-sanctions-global [https://perma.cc/M5J2-MLXA].Show More Beyond Russia, the U.S. government has used sanctions to target North Korea, Russia, Syria, Venezuela, China, and other countries, as well as institutions and individuals around the world.4 4.For background on the use of sanctions by the United States, see generally Sheelah Kalhatkar, Will Sanctions Against Russia End the War in Ukraine? New Yorker (Oct. 24, 2022) (documenting the progression of U.S. sanctions against Russia); Nicholas Mulder, The Economic Weapon: The Rise of Sanctions as a Tool of Modern War (2022) (tracing the international development of sanctions through World War II and their shifting scope and purpose).Show More

Foreign states naturally do not relish the prospect of being targeted by sanctions and have looked for ways to eliminate this risk.5 5.E.g., Frank Tang, China Warned to Prepare For Being Cut Off From US Dollar Payment System as Part of Sanctions Like Russia, S. China Morning Post (June 22, 2020), https://www.scmp.com/economy/china-economy/article/3090119/china-warned-prepare-being-cut-us-dollar-payment-system-part [https://perma.cc/YCC3-AABL]; Karen Brettell, Analysis: As Sanctions “Weaponize” US Dollar, Some Treasury Buyers Could Fall Back, Reuters (Mar. 29, 2022) (describing pressure on foreign governments to diversify their currency use the more the dollar is used as a financial weapon), https://www.reuters.com/business/finance/sanctions-weaponize-us-dollar-some-treasury-buyers-could-fall-back-2022-03-29/ [https://perma.cc/B8A5-HD7U].Show More One option is to reduce reliance on the U.S. dollar, although this requires trade and financial partners willing to deal in other currencies.6 6.This option inevitably prompts inquiry into whether sanctions might lead to the decline of the dollar as global reserve currency. See, e.g., Michael P. Dooley, David Folkerts-Landau & Peter M. Garber, US Sanctions Reinforce the Dollar’s Dominance (Nat’l Bureau Econ. Rsch., Working Paper No. 29943, 2022), https://www.nber.org/system/files/working_papers/w29943/w29943.pdf [https://perma.cc/MGW2-DTU9].Show More More commonly, foreign parties seek ways to bypass or evade U.S. sanctions.7 7.For a discussion of some of the responses to U.S. financial sanctions, see Pierre-Hugues Verdier, Global Banks on Trial: U.S. Prosecutions and the Remaking of International Finance 109–45 (Oxford Univ. Press 2020).Show More In this Essay, we examine one such strategy, which the Russian Federation adopted after the sanctions prompted by its annexation of Crimea. The Russian government appears to have worried—presciently, as it turns out—that future sanctions would force it to default on its international debt. It sought to prevent this by clever contract drafting.

In 2016, the Russian government was already sanctioned and anticipated that its future conduct might trigger even harsher sanctions. It began to include an “Alternate Payment Currency” (APC) clause in its international bonds—that is, bonds denominated in foreign currency.8 8.See Lev E. Breydo, Russia’s Bond Roulette, Am. Bar Ass’n (May 20, 2022), https://www.americanbar.org/groups/business_law/publications/blt/2022/06/russia-bond-roulette/ [https://perma.cc/5TEZ-ZGJ9].Show More The clause lets the government pay in an alternative currency if, “for reasons beyond its control,” it cannot pay in the currency specified in the bond. The APC clause first appeared in a U.S. Dollar (USD)-denominated bond and specified alternative currencies over which the Russian government had no control: Euros, Pound sterling, and Swiss francs.9 9.Prospectus for Russian Federation 4.75% USD bonds due 2026, at 3 (May 26, 2016), https://ise-prodnr-eu-west-1-data-integration.s3-eu-west-1.amazonaws.com/legacy/Prospectus+-+Standalone_7cc3442b-cb8c-4394-bc26-33f9ce656e56.pdf [https://perma.cc/YDY6-8ANP].Show More But, since March 2018, the country’s international bonds have included Russia’s rouble in the list of alternatives. It is the last option; the country must pay in foreign currency if possible. But if not, it can pay in roubles. The meaning of this clause has not been tested in court. At least arguably, the clause lets the Russian government avoid a debt default by paying bondholders in roubles when financial sanctions shut it off from the dollar payment system.

The APC clause is exceptional for multiple reasons. For one thing, we cannot think of other cases in which a country’s sovereign bonds have included an explicit sanctions-busting mechanism. For another, the clause functions as a sort of force majeure clause. In its classic sense, a force majeure clause temporarily excuses a party’s non-performance of its contractual obligations when circumstances outside its control make performance impossible.10 10.Anthony Michael Sabino, The Force Majeure Awakens, N.Y. L.J. (May 16, 2022), https://www.law.com/newyorklawjournal/2022/05/16/the-force-majeure-awakens/ [https://perma.cc/3KBJ-QYRX]. These clauses received considerable attention as a result of the COVID-19 pandemic, since there was considerable debate as to whether the pandemic was a force majeure event. See e.g., Andrew A. Schwartz, Contracts and COVID-19, 73 Stan. L. Rev. 48, 56–58 (2020).Show More But sovereign bonds generally do not include force majeure clauses; the sovereign’s payment obligation is unconditional. In sovereign debt markets, the closest thing to a force majeure clause is the so-called Natural Disaster clause, which allows the issuer to defer payments in the event of a qualifying natural disaster.11 11.Sui-Jim Ho & Stephanie Fontana, Sovereign Debt Evolution: The Natural Disaster Clause, 11 Emerging Mkts. Restructuring J. 5, 5 (2021).Show More Rather than provide for a suspension of payments, the APC clause allows the debtor to use its domestic currency when it cannot access foreign currency.

The formulation of the APC clause as an option to pay in domestic currency has implications beyond the sanctions context. The clause applies to all circumstances where the sovereign cannot access foreign currency for reasons beyond its control. Historically, a loss of such access is a primary reason why sovereigns encounter financial distress.12 12.Barry Eichengreen, Asmaa El-Ganainy, Rui Pedro Esteves & Kris James Mitchener, Public Debt Through the Ages, in Sovereign Debt 7, 33–36 (S. Ali Abbas ed., 2019).Show More The APC clause thus provides a contractual escape hatch from what economists refer to as the problem of “original sin.”13 13.For the classic work on this topic, see Barry Eichengreen, Ricardo Hausmann & Ugo Panizza, The Mystery of Original Sin, in Other People’s Money: Debt Denomination and Financial Instability in Emerging Market Economies (Barry Eichengreen & Ricardo Hausmann eds., 2005); Ricardo Hausmann & Ugo Panizza, Redemption or Abstinence? Original Sin, Currency Mismatches and Counter Cyclical Policies in the New Millennium, 2 J. Globalization & Dev. 1 (2011).Show More A country that cannot borrow abroad in its own currency exposes itself to exchange rate volatility and other risks that can undermine economic stability. High interest rates or weak commodity prices can prompt a debt crisis, which can be avoided if the borrower can temporarily resort to payment in domestic currency. Emerging market borrowers have gradually shifted more of their borrowing into domestic currency, but many have substantial debts denominated in foreign currencies. It may be that Russia, despite causing global chaos and a humanitarian disaster in Ukraine, has inadvertently created a contractual innovation that could benefit other borrowers.

However, the benefit of the APC clause depends on its price. One reason countries borrow in foreign currency is that it is cheaper to do so. A key question, then, is what the pricing implications of using the APC clause have been. How much did the markets charge Russia for the clause? And, once events occurred that brought the clause into play, how did the markets react? In this Essay, we use data on Russian bond prices to analyze these questions.

Our prediction was that the market would charge Russia a premium for using the APC clause. This is because investors who buy international bonds generally do not wish to be repaid in the borrower’s domestic currency, and also because investors might interpret the mere presence of the clause as a signal that Russia anticipated engaging in conduct that would prompt additional sanctions. Conceivably, this premium would not be apparent at the time of issuance. The financial press covered the introduction of the rouble APC clause in 2018, so it could hardly have escaped investors’ notice.14 14.E.g., Jonathan Wheatley, Russia Bond Sales Allow Payments in Alternative Currencies, Fin. Times (Mar. 17, 2018), https://www.ft.com/content/69da000c-2915-11e8-b27e-cc62a39d57a0 [https://perma.cc/UVN8-8Y9J].Show More At the time, however, investors may have been sanguine about the prospect of future sanctions. Certainly, Russia was viewed as a strong creditor, and the bonds were heavily oversubscribed. But during late 2021 and early 2022, the prospect of an invasion of Ukraine became increasingly real. We expected that the market penalty for APC bonds would increase once the invasion (and, thus, additional sanctions) grew increasingly certain.

Markets did not react as we expected. Initially, the market seemed indifferent to the clause, even as Russian forces massed on the Ukrainian border. Once the invasion occurred, the market seemed to wake up to the presence of the APC clause. But rather than charge a premium for APC bonds, as we had expected, the market seemed to value them more highly than comparable bonds without the clause. Although there are dynamics unique to Russian sovereign debt, these findings also suggest that, despite its provenance, the Russian APC clause might be a positive innovation from which other countries facing the risk of unexpected crises could benefit. Indeed, Ukraine itself, which likely faces an unpayable debt burden due to the Russian invasion, would have realized an enormous benefit from such a clause.

I. Background on the APC Clause

The core feature of the APC clause is that it allows the issuer of a dollar or euro bond to pay in roubles if neither the designated currency nor a list of stable alternative currencies is available, and the reason is outside the control of the issuer. As an example, here is the relevant text of the APC clause in a 2019 issuance of dollar bonds by the Russian Federation:

Notwithstanding any other provision in these Conditions, if, for reasons beyond its control, the Russian Federation is unable to make payments of principal or interest (in whole or in part) in respect of the Bonds in U.S. dollars (an “Alternative Payment Currency Event”), the Russian Federation shall make such payments (in whole or in part) in the Alternative Payment Currency on the due date at the Alternative Payment Currency Equivalent of any such U.S. dollar-denominated amount…

….

“Alternative Payment Currency” means Euros, Pound sterling or Swiss francs or, if for reasons beyond its control the Russian Federation is unable to make payments of principal or interest (in whole or in part) in respect of the Bonds in any of these currencies, Russian roubles.15 15.Prospectus for Russian Federation 5.10% USD bonds due 2035, at 66–68 (Mar. 26, 2019), [https://perma.cc/3YBJ-8MYV].Show More

Several aspects of the clause are noteworthy. First, of course, is that it lets the government pay in roubles under circumstances in which, but for the APC clause, it would likely be forced into a payment default. Second, the right to pay in roubles is triggered only if the government cannot pay in a preferred currency “for reasons beyond its control.” The contract does not say when circumstances are outside the Russian government’s control, but the clause is broad enough to cover the types of circumstances that get many emerging markets into trouble (for example, currency outflows that create a liquidity crisis). As events have turned out, Russia has not attempted to invoke the clause, and it is an open question whether the present circumstances are outside its control.16 16.The Russian government has indicated that it intends to pay all of its international bonds in roubles. The Associated Press, Russia Says it Will Pay Foreign Debt in Rubles After U.S. Ban, Associated Press News (May 25, 2022), https://apnews.com/article/russia-ukraine-janet-yellen-government-and-politics-65af86cf89023fbc213c54ab11f212ee [https://perma.cc/29H3-2G54]. This is a default for non-APC bonds and at least a technical default under the APC bonds, since the government has not complied with notice and other procedures applicable to rouble payments. But these are relatively recent developments.Show More Western sanctions are the proximate cause of Russia’s inability to make dollar and euro payments, and Russia cannot directly control the sanctions. But it could presumably entice Western governments to remove them by withdrawing from Ukraine and credibly committing to respect the country’s borders. The question would have to be decided by a court applying English law (the law designated in the contract).

However, it is not a stretch to interpret the APC clause to allow payment in roubles. It does seem that the intent of the clause was to address the scenario in which sanctions cut off access to dollar and euro payment systems. The prospectuses for the APC bond issuances explicitly point to the risk that Western sanctions might jeopardize Russia’s ability to pay in foreign currency.17 17.See Mark Weidemaier & Mitu Gulati, Should Investors Who Care About ESG Buy Russian Sovereign Bonds?, Credit Slips (Mar. 15, 2022), https://www.creditslips.org/creditslips/2022/03/should-investors-who-care-about-esg-buy-russian-sovereign-bonds.html [https://perma.cc/EN8T-4JF6].Show More For example, the prospectus for sovereign bonds issued in 2020 details the history of Western sanctions, warns that “continued geopolitical tensions” and new sanctions might put downward pressure on the rouble, and cautions that this might “adversely affect … the Russian Federation’s ability to repay its debt denominated in currencies other than the rouble, including amounts due under the Bonds.”18 18.Prospectus for EUR 750 million 1.125% bonds due 2027, at 17 (Nov. 18, 2020), https://www.creditslips.org/files/nov-2020-prospectus.pdf [https://perma.cc/W6JB-TKRF].Show More Courts generally interpret contracts in a manner consistent with the parties’ presumed intent. This language implies that the intent of the APC clause is to allow payment in roubles when sanctions cut off access to other currencies.19 19.E.g., Guy Faulconbridge & Karin Strohecker, Russia Warns Sovereign Bond Holders That Payments Depend on Sanctions, Reuters (Mar. 6, 2022), https://www.reuters.com/markets/rates-bonds/russia-says-sovereign-bond-payments-will-depend-sanctions-2022-03-06/ [https://perma.cc/B5T8-4JEY] (noting that the APC was put into bonds in the wake of western sanctions that were imposed as a result of Russia’s Crimean incursion in 2014); Wheatley, supra note 14 (same).Show More Moreover, Gazprom, Russia’s state-owned energy company, also has issued APC bonds. Gazprom has an even better argument for paying in roubles, since its conduct did not prompt the sanctions. We do not think the issue is clear cut for either bond issuer. Bondholder lawsuits probably would be heard by courts in London, and the United Kingdom is one of the sanctioning countries. An English court might be unwilling to let Russian parties continue to pay bondholders in roubles.20 20.For a discussion of this rather unclear basis on which courts across different legal settings periodically invalidate contracts, see Farshad Ghodoosi, The Concept of Public Policy in Law, 94 Neb. L. Rev. 685, 711 (2016); Percy H. Winfield, Public Policy in the English Common Law, 42 Harv. L. Rev. 76, 88, 93 (1928) (discussing differences among judges as to when public policy should void a contract).Show More But it is at least plausible that a court would interpret the clause to allow rouble payments.

So interpreted, the APC clause establishes a mechanism for evading sanctions and, at least potentially, avoiding a payment default. That is a clear benefit to Russia. And while investors who receive rouble payments might worry that the Russian government will manipulate exchange rates or impose capital controls, these are not certainties given the government’s apparent determination to maintain good relations with the market.21 21.The bond contracts are not entirely clear, but they appear to give the Russian government room to manipulate the exchange rate by allowing the NSD, an arm of the Russian government acting as its central securities depository, to determine the exchange rate by reference to the rates quoted by banks in Moscow.Show More

II. Empirical Analysis

We base our analysis on a dataset of sovereign and Gazprom bond issuances as reported on Bloomberg. Overall, we have data on 28 issuances. For simplicity, we focus the empirical analysis on bond pairs, although we have replicated our analysis using bond portfolios. We selected eight bonds with similar maturities to study the impact of the APC clause on the yield spread: two sovereign bonds in roubles, two sovereign bonds in U.S. dollars, two Gazprom bonds in U.S. dollars, and two Gazprom bonds in euros.

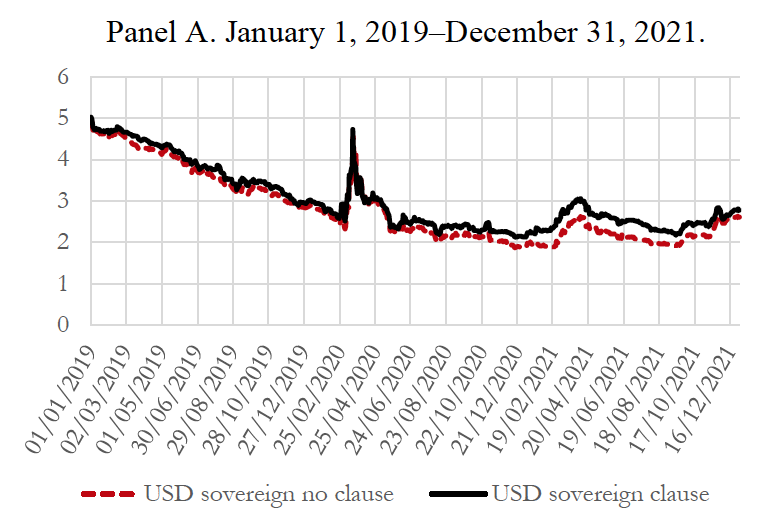

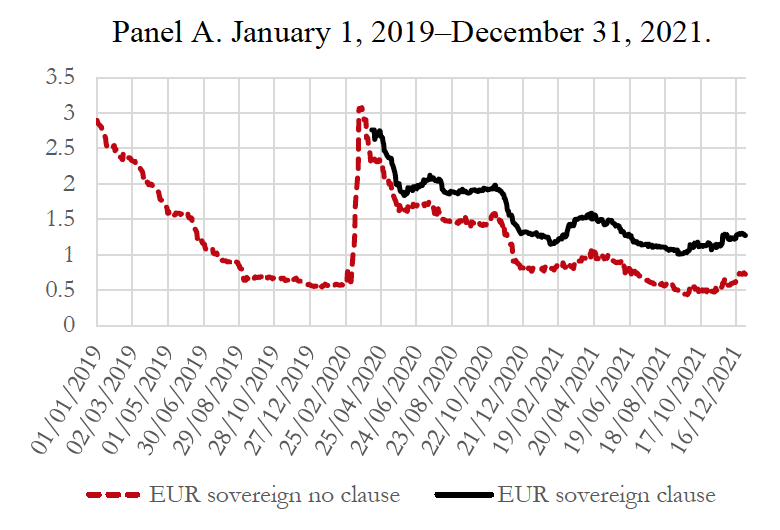

Figure 1 shows the daily yield to maturity for the pair of sovereign bonds issued in U.S. dollars.22 22.The pair consists of USD bonds with relatively closely matched maturities: June 23, 2027, for the non-APC bond (“no clause”) and March 21, 2029, for the APC bond (“clause”). Figure 1: Panel A shows the yield to maturity from January 1, 2019, to December 31, 2021; Panel B from January 1, 2022, to September 21, 2022, and Panel C from January 1, 2019, to September 21, 2022.Show More First, we observe a big jump in the yield for both bonds on the date of the Russian invasion (February 24, 2022). Second, from the beginning of 2019 through the date of the invasion, the yield on the two bonds was quite close. On average, over the pre-invasion time period, the yield of the bond with the APC clause is slightly higher than the bond without the clause, but the difference is not statistically significant. After the invasion, the relationship flips and increases considerably in both magnitude and significance. This implies that the market perceived APC bonds as less risky than non-APC bonds. This is the opposite of what we expected.

FIGURE 1. Yield to maturity, percentage, USD sovereign pair.

Panel A. January 1, 2019–December 31, 2021. Panel A. January 1, 2019–December 31, 2021. |

Panel B. January 1, 2022–September 21, 2022. Panel B. January 1, 2022–September 21, 2022. |

Panel C. January 1, 2019–September 21, 2022. Panel C. January 1, 2019–September 21, 2022. |

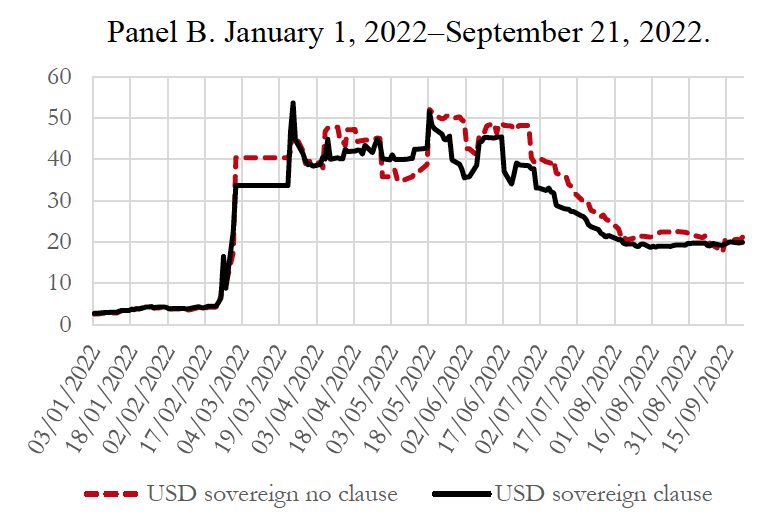

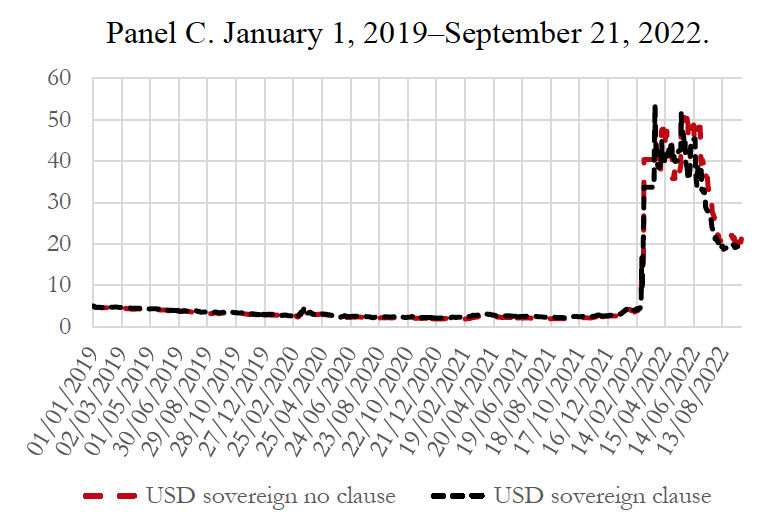

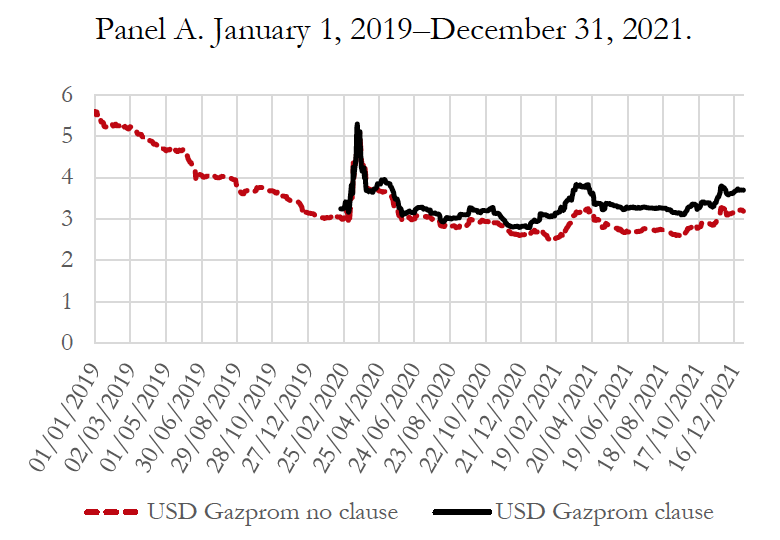

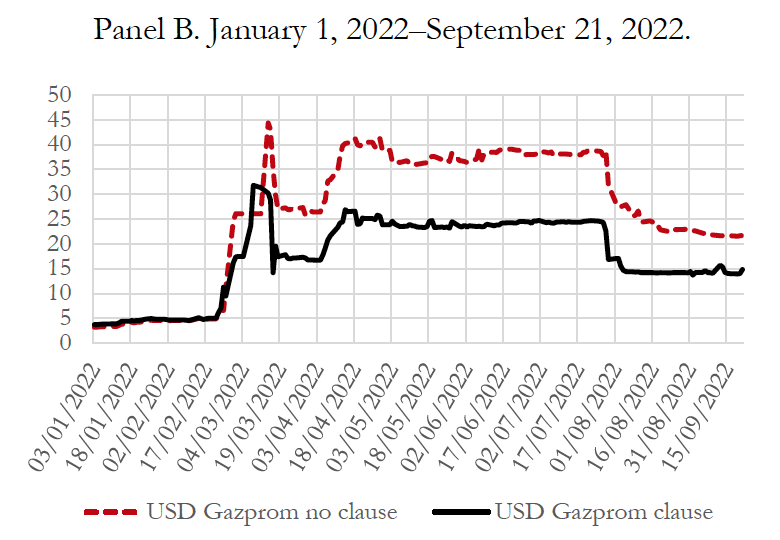

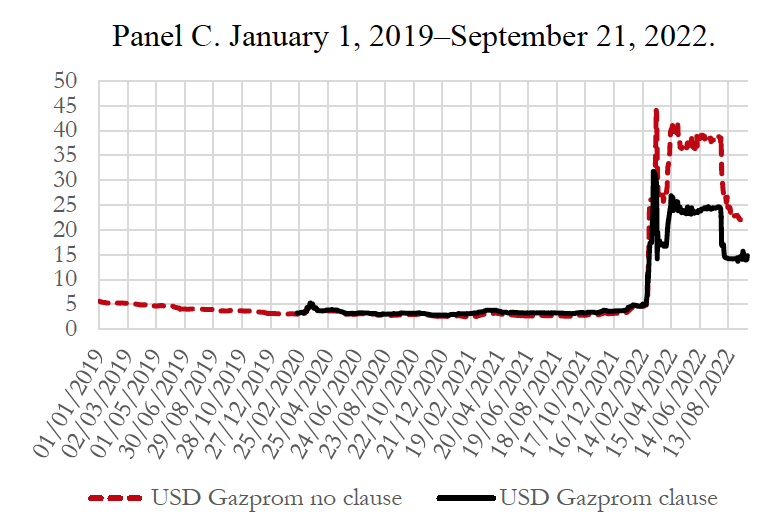

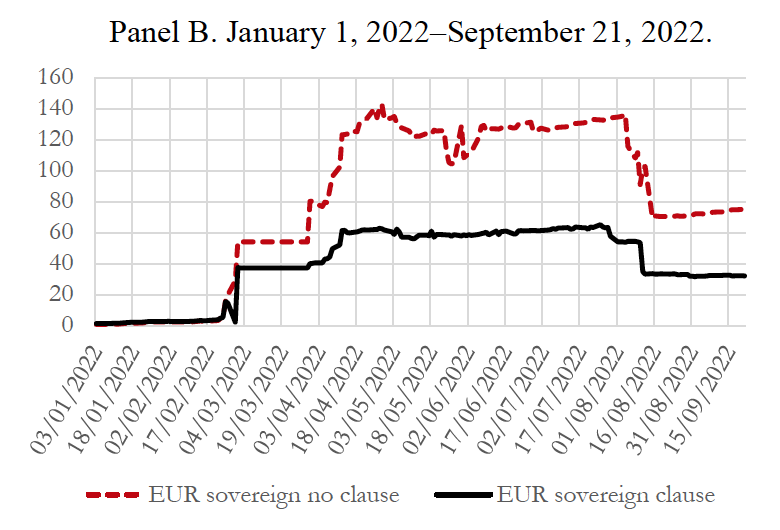

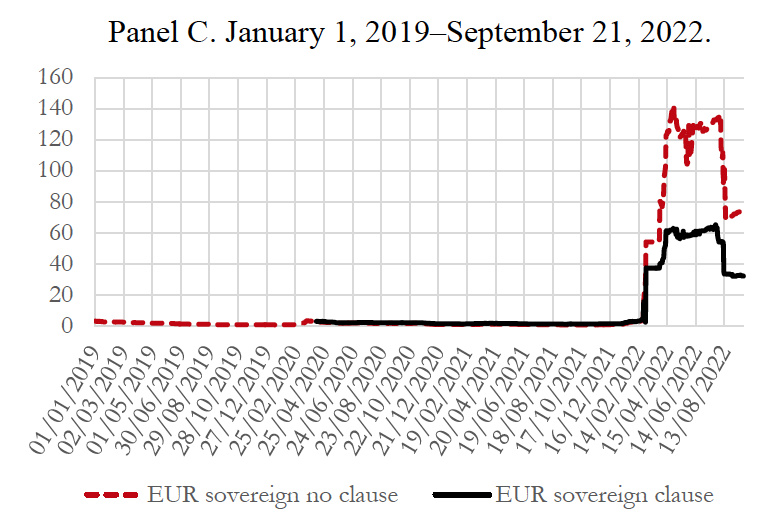

We also analyze pairs of dollar- and euro-denominated Gazprom bonds and observe the same dynamics. Indeed, the pattern is even clearer.23 23.The Gazprom USD pair consists of a non-APC bond maturing March 23, 2027, and an APC bond maturing February 25, 2030. The EUR pair includes a non-APC bond maturing November 17, 2023, and an APC bond maturing April 15, 2025.Show More As shown in Figures 2 and 3, there is basically no pricing difference between APC and non-APC bonds until the invasion. 24 24.Figures 2 and 3: Panel A shows the yield to maturity from January 1, 2019, to December 31, 2021; Panel B from January 1, 2022, to September 21, 2022, and Panel C from January 1, 2019, to September 21, 2022.Show More After that, yields spike for both bonds but dramatically more for the non-APC bond. Again, post-invasion investors seem to view APC bonds as less risky than comparable bonds without the clause.

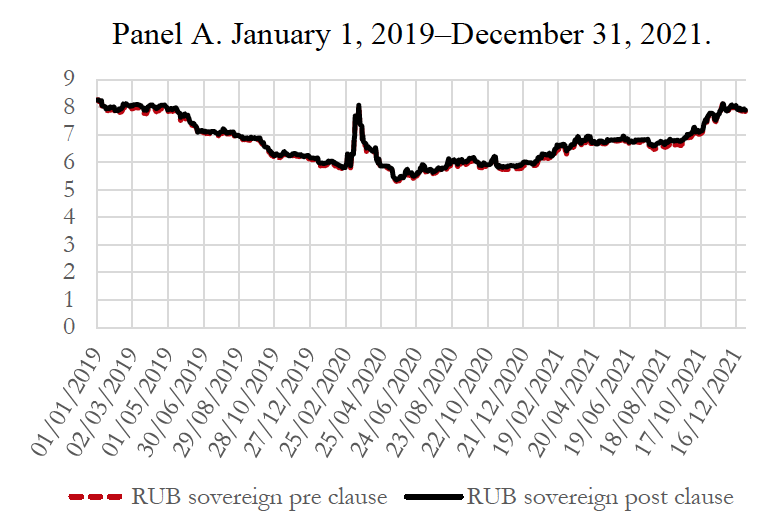

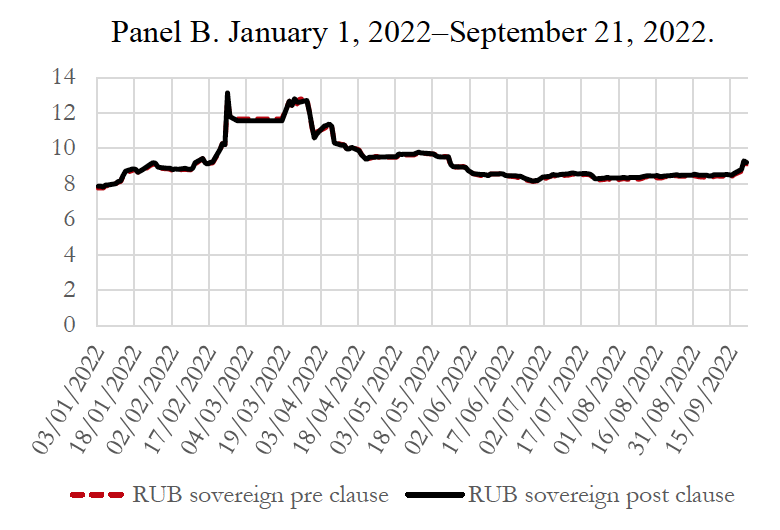

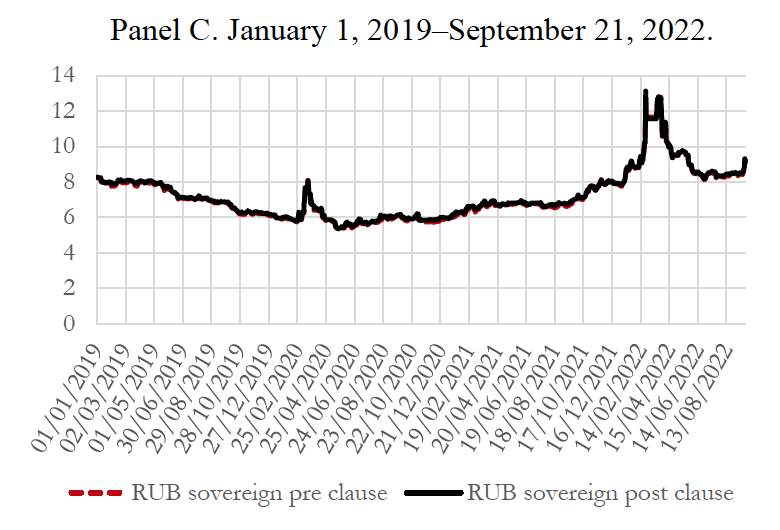

As a contrast, the pair of sovereign bonds issued in roubles shows little change due to the conflict (Figure 4).25 25.Figure 4: Panel A shows the yield to maturity from January 1, 2019, to December 31, 2021; Panel B from January 1, 2022, to September 21, 2022, and Panel C from January 1, 2019, to September 21, 2022.Show More Neither bond shows an abrupt jump, suggesting that investors with rouble bonds were confident of continuing to get paid even after Russia invaded Ukraine and was subject to severe western sanctions.

FIGURE 2. Yield to maturity, percentage, USD Gazprom pair.

Panel A. January 1, 2019–December 31, 2021. Panel A. January 1, 2019–December 31, 2021. |

Panel B. January 1, 2022–September 21, 2022. Panel B. January 1, 2022–September 21, 2022. |

Panel C. January 1, 2019–September 21, 2022. Panel C. January 1, 2019–September 21, 2022. |

FIGURE 3. Yield to maturity, percentage, EUR Gazprom pair.

Panel A. January 1, 2019–December 31, 2021. Panel A. January 1, 2019–December 31, 2021. |

Panel B. January 1, 2022–September 21, 2022. Panel B. January 1, 2022–September 21, 2022. |

Panel C. January 1, 2019–September 21, 2022. Panel C. January 1, 2019–September 21, 2022. |

FIGURE 4. Yield to maturity, percentage, RUB sovereign pair.

Panel A. January 1, 2019–December 31, 2021. Panel A. January 1, 2019–December 31, 2021. |

Panel B. January 1, 2022–September 21, 2022. Panel B. January 1, 2022–September 21, 2022. |

Panel C. January 1, 2019–September 21, 2022. Panel C. January 1, 2019–September 21, 2022. |

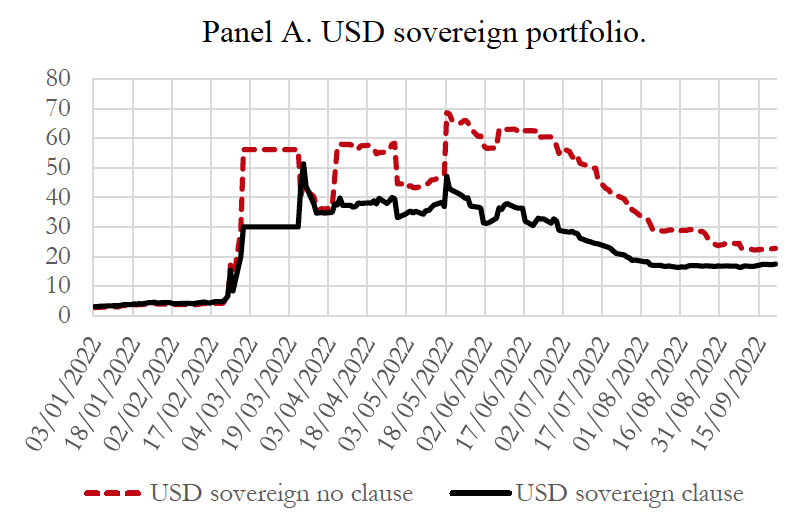

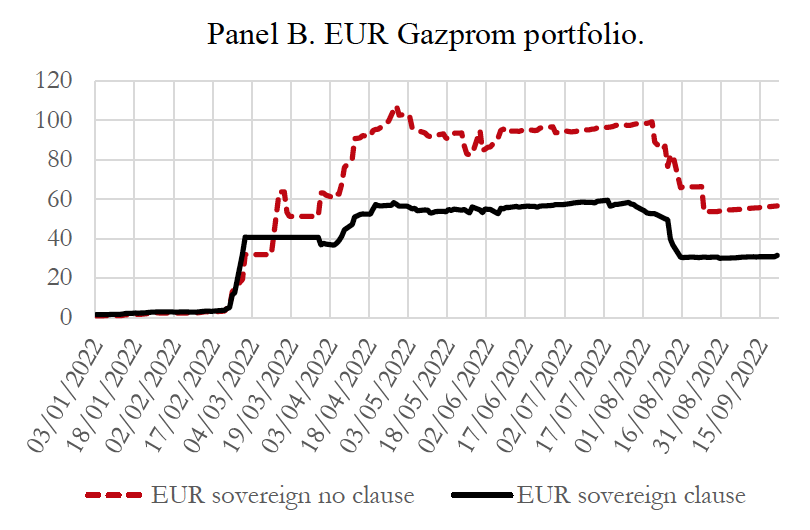

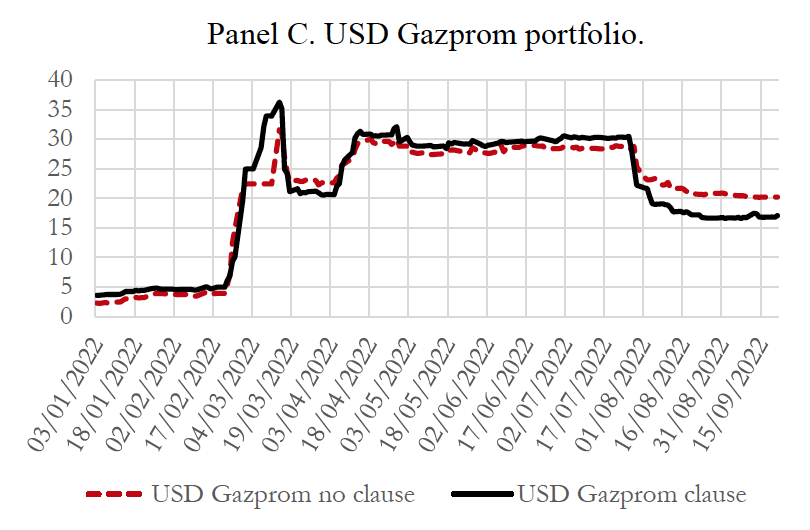

The analyses above isolate the effect of the APC clause by comparing bond pairs with similar maturity dates. We also replicated our results by constructing portfolios of bonds with and without the APC clause.26 26.The USD sovereign portfolio includes 2 APC bonds and 5 non-APC bonds. The USD Gazprom portfolio includes 4 APC bonds and 2 non-APC bonds. The EUR Gazprom portfolio includes 5 APC bonds and 2 non-APC bonds. All the bonds used in the pair analysis are included in the portfolios.Show More The results are essentially the same as in the pairs analysis. Figure 5 illustrates the dynamics of the yield to maturity among the different portfolios during 2022.27 27.Figure 5: Panel A shows the yield to maturity from January 1, 2019, to December 31, 2021; Panel B from January 1, 2022, to September 21, 2022, and Panel C from January 1, 2019, to September 21, 2022.Show More The only difference we observe is that, for the Gazprom bonds issued in USD, the difference in the yield between the portfolios with and without the clause is statistically negligible after the invasion. (A deeper difference appears by the end of July.)

FIGURE 5. Yield to maturity, percentage, portfolio (January 1, 2022–September 21, 2022).

Panel A. USD sovereign portfolio. Panel A. USD sovereign portfolio. |

Panel B. EUR Gazprom portfolio. Panel B. EUR Gazprom portfolio. |

Panel C. USD Gazprom portfolio. Panel C. USD Gazprom portfolio. |

III. Implications

A point worth mentioning at the outset, although not central to our inquiry, is that it is something of a puzzle why bonds would move so sharply on the date of the invasion but not before. Throughout late 2021 and early 2022, the information available to investors suggested an increasing probability of Russian invasion. Investors who had a view as to how the war would affect the relative value of bonds with and without the APC clause could have adjusted their positions in anticipation. Yet we observe little impact on bond yields until the invasion itself, almost as if the event was unanticipated.

For our purposes, the most striking finding has to do with how the market viewed bonds with the APC clause relative to bonds without the clause. Begin with the fact that, pre-invasion, the market did not seem to distinguish between the two types of bonds. Bonds denominated in foreign currency protect investors from fluctuation in the value of the borrower’s domestic currency. Investors who purchase foreign currency bonds generally value this protection. Yet contrary to our expectations, we do not observe the market charging a premium for holding bonds with the APC clause. That is, even though APC bonds allow the government to pay in roubles when it cannot pay in foreign currency, investors did not appear to view this as meaningful enough of a source of risk to increase the interest rate they demanded.

If Russia, not exactly a paragon of virtue, could include this clause without the market charging a premium, perhaps other, more virtuous, nations could also adopt something like it. As noted earlier, the right to pay in domestic currency when foreign currency is unavailable could provide significant protection to other countries facing common distress scenarios, such as temporary illiquidity caused by currency outflows. Although countries are generally reluctant to adopt new contract terms because they fear the market will penalize them for doing so, there is no evidence that the Russian government suffered such a penalty.

Of course, Russia is not a typical emerging market borrower. It had amassed an enormous war chest of foreign exchange. Investors faced little risk that poor macroeconomic policies would cause Russia to run out of dollars or euros. The real risk was that Western sanctions would deny Russia access to dollar and euro payment systems. Maybe investors would view the APC clause more skeptically if adopted by a borrower without such large foreign exchange reserves. Ex ante, investors might worry that the clause would create moral hazard—effectively insuring the borrower against some of the cost associated with imprudent economic policies. However, note that the text of the clause would seem to preclude this, since it only assists the sovereign in circumstances outside of its control. And, if investors were concerned, they could specify additional constraints in the contract.

Recall also that post-invasion yields on Russian APC bonds were significantly lower than yields on bonds without the clause. This finding implies that, once a crisis has arrived, investors may react favorably to bonds that allow for payment in domestic currency. After all, the alternative may be to receive nothing. To be sure, after a payment default, the investor can file a lawsuit, and it will likely win a court judgment entitling it to be paid in foreign currency. But it will take significant amounts of time and money to collect that judgment. At least for some investors, a bond that allows the government to make payments in domestic currency may be the lesser of two evils.

We do not mean to overstate the case for the APC clause. For a clause like this to work, investors would need confidence that the clause would not invite moral hazard. In principle, that confidence could come from having a respected institution—a court in New York or London, for instance—decide whether the borrower was responsible for the financial conditions that cut it off from access to foreign exchange. Only when the conditions were truly outside of the borrower’s control would the clause be triggered. We suspect, however, that there are simpler ways to condition the borrower’s payment obligations on its underlying financial condition. That is the goal, for instance, of proposals for sovereigns to issue bonds that link payment to GDP. No doubt there are other ways to design contracts to insulate borrower from economic shocks outside of its control. Perhaps the most enticing aspect of our findings with regard to Russian sovereign bonds is that countries might be able to adopt such clauses without prompting investors to run for the hills.

- For a comprehensive timeline of sanctions imposed against Russia by the United States and other countries, see Chad P. Bown, Russia’s War on Ukraine: A Sanctions Timeline, Peterson Inst. for Int’l Econ., https://www.piie.com/blogs/realtime-economic-issues-watch/russias-war-ukraine-sanctions-timeline [https://perma.cc/MEL7-E7QH]. ↑

- Benjamin Coates, A Century of Sanctions, Current Events in Historical Perspective, Ohio St. U.: Origins (Dec. 2019), https://origins.osu.edu/article/economic-sanctions-history-trump-global?language_content_entity=en [https://perma.cc/B94U-3X9F]. ↑

- See, e.g., America’s Aggressive Use of Sanctions Endangers the Dollar’s Reign, Economist (Jan. 18, 2020), https://www.economist.com/briefing/2020/01/18/americas-aggressive-use-of-sanctions-endangers-the-dollars-reign [https://perma.cc/K2HY-SG4W]; Karen Yeung, How the US Uses the Dollar Payments System to Impose Sanctions on a Global Scale, S. China Morning Post (Aug. 25, 2020), https://www.scmp.com/economy/china-economy/article/3098691/how-us-uses-dollar-payments-system-impose-sanctions-global [https://perma.cc/M5J2-MLXA]. ↑

- For background on the use of sanctions by the United States, see generally Sheelah Kalhatkar, Will Sanctions Against Russia End the War in Ukraine? New Yorker (Oct. 24, 2022) (documenting the progression of U.S. sanctions against Russia); Nicholas Mulder, The Economic Weapon: The Rise of Sanctions as a Tool of Modern War (2022) (tracing the international development of sanctions through World War II and their shifting scope and purpose). ↑

- E.g., Frank Tang, China Warned to Prepare For Being Cut Off From US Dollar Payment System as Part of Sanctions Like Russia, S. China Morning Post (June 22, 2020), https://www.scmp.com/economy/china-economy/article/3090119/china-warned-prepare-being-cut-us-dollar-payment-system-part [https://perma.cc/YCC3-AABL]; Karen Brettell, Analysis: As Sanctions “Weaponize” US Dollar, Some Treasury Buyers Could Fall Back, Reuters (Mar. 29, 2022) (describing pressure on foreign governments to diversify their currency use the more the dollar is used as a financial weapon), https://www.reuters.com/business/finance/sanctions-weaponize-us-dollar-some-treasury-buyers-could-fall-back-2022-03-29/ [https://perma.cc/B8A5-HD7U]. ↑

- This option inevitably prompts inquiry into whether sanctions might lead to the decline of the dollar as global reserve currency. See, e.g., Michael P. Dooley, David Folkerts-Landau & Peter M. Garber, US Sanctions Reinforce the Dollar’s Dominance (Nat’l Bureau Econ. Rsch., Working Paper No. 29943, 2022), https://www.nber.org/system/files/working_papers/w29943/w29943.pdf [https://perma.cc/MGW2-DTU9]. ↑

- For a discussion of some of the responses to U.S. financial sanctions, see Pierre-Hugues Verdier, Global Banks on Trial: U.S. Prosecutions and the Remaking of International Finance 109–45 (Oxford Univ. Press 2020). ↑

- See Lev E. Breydo, Russia’s Bond Roulette, Am. Bar Ass’n (May 20, 2022), https://www.americanbar.org/groups/business_law/publications/blt/2022/06/russia-bond-roulette/ [https://perma.cc/5TEZ-ZGJ9]. ↑

- Prospectus for Russian Federation 4.75% USD bonds due 2026, at 3 (May 26, 2016), https://ise-prodnr-eu-west-1-data-integration.s3-eu-west-1.amazonaws.com/legacy/Prospectus+-+Standalone_7cc3442b-cb8c-4394-bc26-33f9ce656e56.pdf [https://perma.cc/YDY6-8ANP]. ↑

- Anthony Michael Sabino, The Force Majeure Awakens, N.Y. L.J. (May 16, 2022), https://www.law.com/newyorklawjournal/2022/05/16/the-force-majeure-awakens/ [https://perma.cc/3KBJ-QYRX]. These clauses received considerable attention as a result of the COVID-19 pandemic, since there was considerable debate as to whether the pandemic was a force majeure event. See e.g., Andrew A. Schwartz, Contracts and COVID-19, 73 Stan. L. Rev. 48, 56–58 (2020). ↑

- Sui-Jim Ho & Stephanie Fontana, Sovereign Debt Evolution: The Natural Disaster Clause, 11 Emerging Mkts. Restructuring J. 5, 5 (2021). ↑

- Barry Eichengreen, Asmaa El-Ganainy, Rui Pedro Esteves & Kris James Mitchener, Public Debt Through the Ages, in Sovereign Debt 7, 33–36 (S. Ali Abbas ed., 2019). ↑

- For the classic work on this topic, see Barry Eichengreen, Ricardo Hausmann & Ugo Panizza, The Mystery of Original Sin, in Other People’s Money: Debt Denomination and Financial Instability in Emerging Market Economies (Barry Eichengreen & Ricardo Hausmann eds., 2005); Ricardo Hausmann & Ugo Panizza, Redemption or Abstinence? Original Sin, Currency Mismatches and Counter Cyclical Policies in the New Millennium, 2 J. Globalization & Dev. 1 (2011). ↑

- E.g., Jonathan Wheatley, Russia Bond Sales Allow Payments in Alternative Currencies, Fin. Times (Mar. 17, 2018), https://www.ft.com/content/69da000c-2915-11e8-b27e-cc62a39d57a0 [https://perma.cc/UVN8-8Y9J]. ↑

- Prospectus for Russian Federation 5.10% USD bonds due 2035, at 66–68 (Mar. 26, 2019), [https://perma.cc/3YBJ-8MYV]. ↑

- The Russian government has indicated that it intends to pay all of its international bonds in roubles. The Associated Press, Russia Says it Will Pay Foreign Debt in Rubles After U.S. Ban, Associated Press News (May 25, 2022), https://apnews.com/article/russia-ukraine-janet-yellen-government-and-politics-65af86cf89023fbc213c54ab11f212ee [https://perma.cc/29H3-2G54]. This is a default for non-APC bonds and at least a technical default under the APC bonds, since the government has not complied with notice and other procedures applicable to rouble payments. But these are relatively recent developments. ↑

- See Mark Weidemaier & Mitu Gulati, Should Investors Who Care About ESG Buy Russian Sovereign Bonds?, Credit Slips (Mar. 15, 2022), https://www.creditslips.org/creditslips/2022/03/should-investors-who-care-about-esg-buy-russian-sovereign-bonds.html [https://perma.cc/EN8T-4JF6]. ↑

- Prospectus for EUR 750 million 1.125% bonds due 2027, at 17 (Nov. 18, 2020), https://www.creditslips.org/files/nov-2020-prospectus.pdf [https://perma.cc/W6JB-TKRF]. ↑

- E.g., Guy Faulconbridge & Karin Strohecker, Russia Warns Sovereign Bond Holders That Payments Depend on Sanctions, Reuters (Mar. 6, 2022), https://www.reuters.com/markets/rates-bonds/russia-says-sovereign-bond-payments-will-depend-sanctions-2022-03-06/ [https://perma.cc/B5T8-4JEY] (noting that the APC was put into bonds in the wake of western sanctions that were imposed as a result of Russia’s Crimean incursion in 2014); Wheatley, supra note 14 (same). ↑

- For a discussion of this rather unclear basis on which courts across different legal settings periodically invalidate contracts, see Farshad Ghodoosi, The Concept of Public Policy in Law, 94 Neb. L. Rev. 685, 711 (2016); Percy H. Winfield, Public Policy in the English Common Law, 42 Harv. L. Rev. 76, 88, 93 (1928) (discussing differences among judges as to when public policy should void a contract). ↑

- The bond contracts are not entirely clear, but they appear to give the Russian government room to manipulate the exchange rate by allowing the NSD, an arm of the Russian government acting as its central securities depository, to determine the exchange rate by reference to the rates quoted by banks in Moscow. ↑

- The pair consists of USD bonds with relatively closely matched maturities: June 23, 2027, for the non-APC bond (“no clause”) and March 21, 2029, for the APC bond (“clause”). Figure 1: Panel A shows the yield to maturity from January 1, 2019, to December 31, 2021; Panel B from January 1, 2022, to September 21, 2022, and Panel C from January 1, 2019, to September 21, 2022. ↑

- The Gazprom USD pair consists of a non-APC bond maturing March 23, 2027, and an APC bond maturing February 25, 2030. The EUR pair includes a non-APC bond maturing November 17, 2023, and an APC bond maturing April 15, 2025. ↑

- Figures 2 and 3: Panel A shows the yield to maturity from January 1, 2019, to December 31, 2021; Panel B from January 1, 2022, to September 21, 2022, and Panel C from January 1, 2019, to September 21, 2022. ↑

- Figure 4: Panel A shows the yield to maturity from January 1, 2019, to December 31, 2021; Panel B from January 1, 2022, to September 21, 2022, and Panel C from January 1, 2019, to September 21, 2022. ↑

- The USD sovereign portfolio includes 2 APC bonds and 5 non-APC bonds. The USD Gazprom portfolio includes 4 APC bonds and 2 non-APC bonds. The EUR Gazprom portfolio includes 5 APC bonds and 2 non-APC bonds. All the bonds used in the pair analysis are included in the portfolios. ↑

-

Figure 5: Panel A shows the yield to maturity from January 1, 2019, to December 31, 2021; Panel B from January 1, 2022, to September 21, 2022, and Panel C from January 1, 2019, to September 21, 2022. ↑

Click on a link below to access the full text of this article. These are third-party content providers and may require a separate subscription for access.